What is Your True Home Buying Power?

Our calculator helps you move beyond generic estimates. Designed for the US housing market, it analyzes your income, debts, and down payment to calculate a realistic home price based on the same debt-to-income (DTI) ratios used by lenders like Fannie Mae and Freddie Mac.

Find out what home price fits your budget. This tool uses your income, debt, and down payment to estimate an affordable home price and your total monthly payment (PITI + HOA).

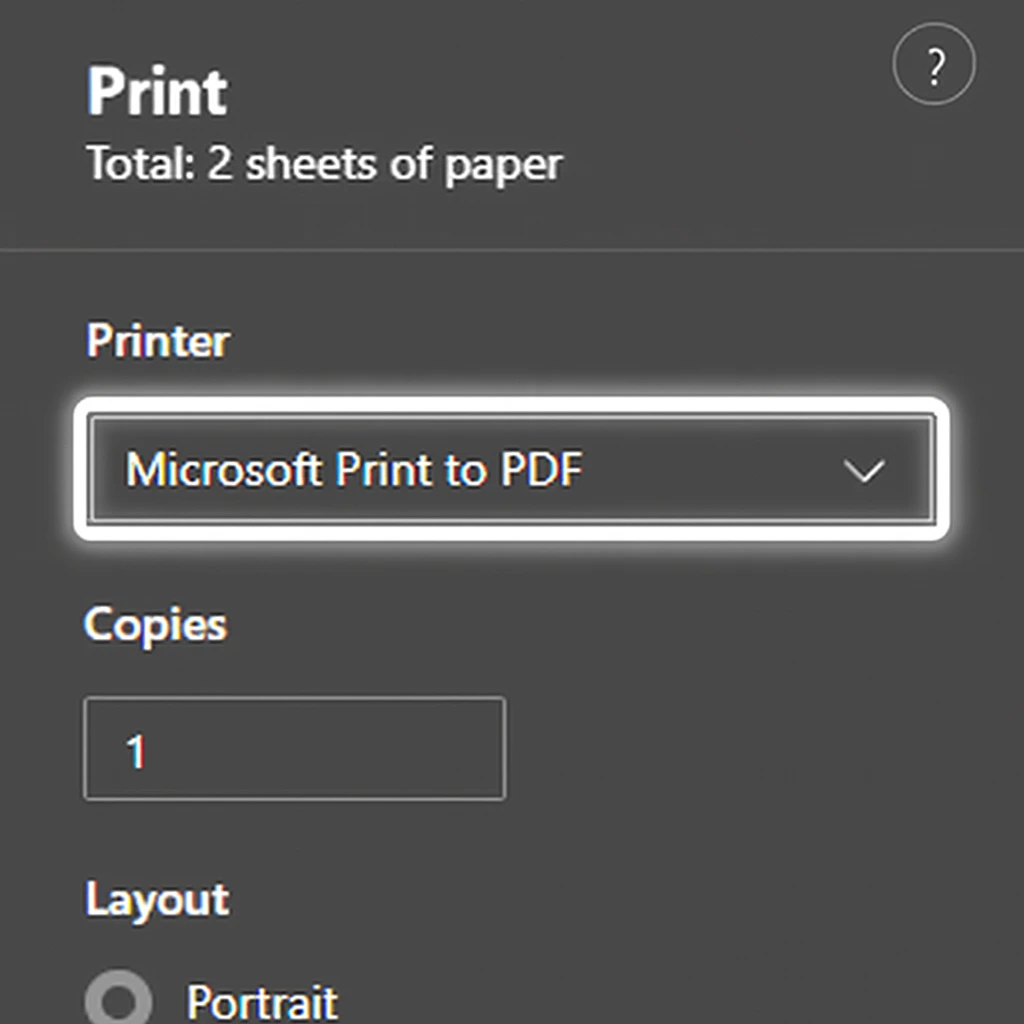

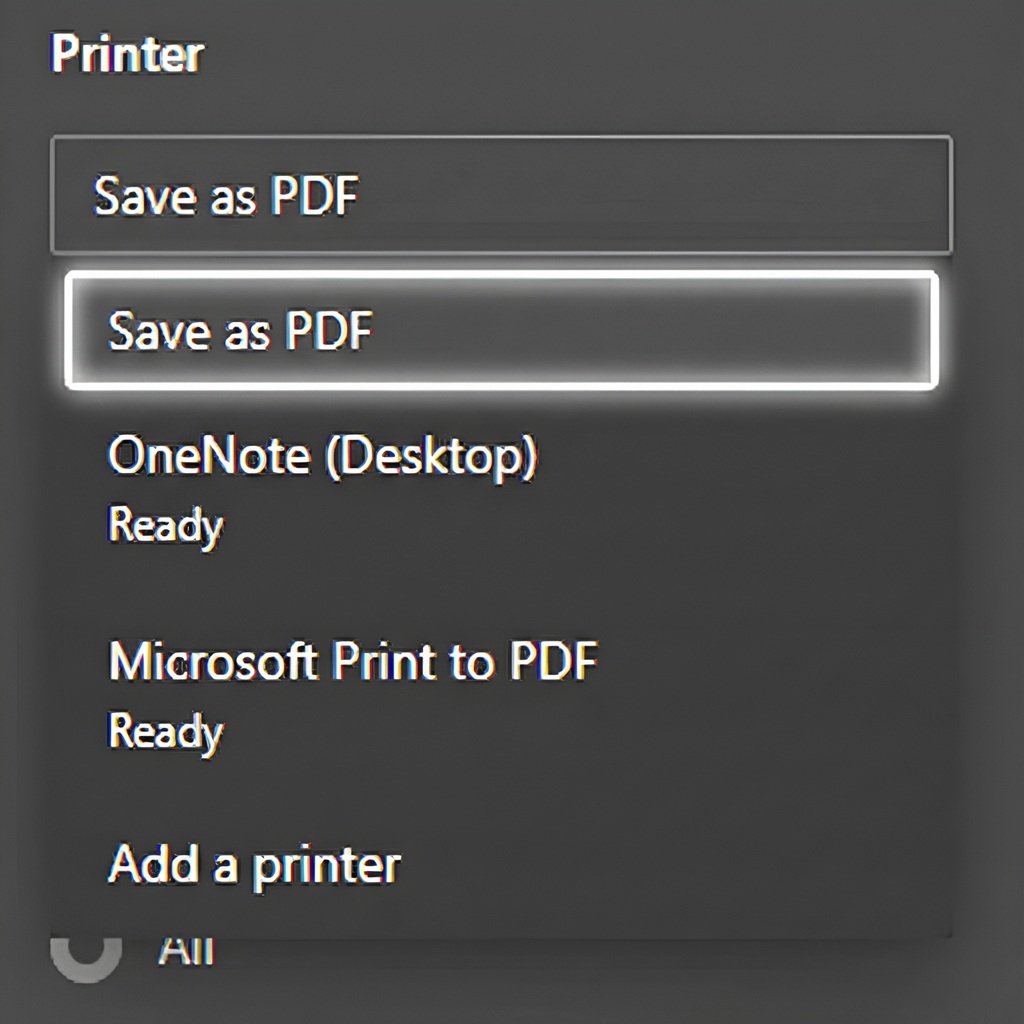

Financial Parameters

Enter Your Details

Loan Profile

Income & Debt

Property & Purchase

Ongoing Costs

Your Affordability

Summary

Enter your details to see a summary of your home affordability.

One-Time Costs

Loan & Ratios

Annual Costs

Monthly House Costs

Monthly Payment Breakdown

See exactly where your money goes. This breakdown visualizes the principal, interest, taxes, and fees that make up your total monthly payment.

More Tools

Continue your financial journey. Use these additional tools to calculate mortgage payments, evaluate refinancing, or decide between renting and buying.

A Practical Guide to This Calculator

This tool is designed to be more than a simple number-cruncher. It's a "what-if" machine. By inputting your real-world financial data, you can build a clear picture of your home-buying power. Here’s how to get the most out of it.

Part 1: Your Financial Profile (Income & Debt)

This is the foundation of your affordability. Lenders will look at this first, and so should you.

- Annual Household Income: Enter the total gross (pre-tax) income for everyone who will be on the mortgage.

- Monthly Debt Payback: This is for your Back-End DTI. Add up all your minimum monthly debt payments: car loans, student loans, credit card minimums, personal loans, etc. Do not include rent or utility bills.

- Max DTI Ratios: The 28/36 rule is the standard for Conventional Loans. A Front-End DTI (28%) is your housing-only cost. A Back-End DTI (36%) includes all debts. Note: FHA Loans and VA Loans often allow higher ratios (up to 43%+), which you can adjust manually in the inputs above.

How the 28/36 Rule Actually Works:

The first limit (28% Front-End) covers your housing-only cost. The second limit (36% Back-End) includes that plus all your debts. Front-end DTI keeps your payment predictable; back-end DTI keeps your entire financial picture stable. When the back-end ratio fails, the loan fails—even if the housing payment alone looks fine. This is where most first-time homebuyer budgets crack.

Part 2: The Purchase & Property Details

This section defines the specifics of the home you're looking for.

- Down Payment: The cash you're paying upfront. This is not the same as "cash at closing." $40,000 down on a $400,000 home is a 10% down payment. (Low down payment options like FHA loans allow for as little as 3.5% down).

- Loan Term & Interest Rate: Use 30 years and the current market rate for a good baseline. You can then see how a 15-year loan or a different rate changes your affordability.

- Ongoing Costs (The PITI): This is critical. Don't just guess. Use a site like Zillow or Redfin to look at actual tax histories and HOA fees for homes in your target price range. An extra $300/month in taxes and HOA fees can reduce your affordable home price by over $40,000.

Strategy: FHA vs. Conventional Loans

An FHA loan (3.5% down) often approves buyers with higher DTIs because FHA’s tolerances are looser. This may let you “buy more house,” but the trade-off is higher monthly mortgage insurance and an upfront MIP fee. Over time, that raises your total cost even if your entry point looks cheaper.

A Conventional loan with 20% down eliminates monthly PMI entirely. This lowers the payment enough that some buyers actually qualify for the same-priced home or higher, despite tighter DTI rules. If you’re debating, remember: underwriters compare monthly cost, not just down payment size.

A Deeper Dive: Understanding Your Affordability Results

The numbers in the results panel tell a story. Here’s how to read them and what they mean for your home-buying journey.

One-Time Costs: The Cash You Need to Close

This is the total liquid cash you'll need on closing day. It’s made of two parts:

1. Down Payment: Your equity stake in the home.

2. Closing Costs: These are "sunk costs" that don't build equity. In the US, this typically includes Origination Fees (paid to the lender), Appraisal Fees ($300–$600), Title Insurance, Recording Fees, and pre-paid Property Taxes.

Note: In some markets, you can negotiate for the seller to pay a portion of these costs (known as "Seller Concessions") to keep your cash out-of-pocket lower.

Loan & Ratios: The 'Why' Behind Your Numbers

This section shows you the Loan Amount you can likely borrow. More importantly, it confirms the Debt-to-Income (DTI) Ratios your affordable payment is based on. Lenders see DTI as a primary measure of risk. Your Front-End DTI is just your new housing payment (PITI+HOA) against your income. Your Back-End DTI includes that *plus* all your other existing debts (car loans, student loans, etc.). This calculator finds the maximum home price that keeps both of these ratios at or below the limits you set.

⚠️ Pro Tip for High-Value Homes: If your estimated loan amount exceeds the Conforming Loan Limit (currently $806,500 for most US counties in 2025), you will likely need a Jumbo Loan. Jumbo loans often require a higher credit score (700+) and larger cash reserves (6–12 months of payments) than the standard rules shown here.

Annual Costs: Budgeting for the Big Picture

It's easy to forget these large, non-mortgage expenses. This section bundles your estimated Property Tax, Homeowners Insurance, HOA Fees, and Maintenance into a yearly total. Many lenders will collect the tax and insurance portions monthly in an "escrow" account and pay them on your behalf. This summary helps you understand the full, long-term financial commitment beyond just the loan.

The "Hidden" Reality: Online calculators often ignore maintenance, but a realistic budget includes a 1% annual reserve (e.g., $333/mo for a $400k home). Property taxes and insurance rise over time, and roofs or HVAC systems do not care about your budget. Underwriters look at long-term sustainability, not just month-one affordability.

Monthly House Costs: Your True Monthly Payment

This is arguably the most important number for your day-to-day budget. This is the total, all-in cost of living in the home each month. It includes not just the mortgage principal and interest (P&I), but also the monthly slices of property taxes, insurance, HOA fees, and estimated maintenance. When you ask, "Can I afford this payment?" this is the number you should be looking at. It ensures you won't be "house poor" and can comfortably cover the complete cost of homeownership.

How to Improve Your Home Affordability

If the "Affordable Home Price" in the results isn't what you'd hoped for, don't be discouraged. You have several powerful levers you can pull to change the outcome. This calculator is the perfect tool to model these scenarios.

1. Reduce Your Monthly Debt (Lower Back-End DTI)

This is often the most impactful change you can make. Every dollar of existing debt (like a car payment or credit card balance) directly reduces the amount of income available for your housing payment. Try this: lower the "Monthly Debt Payback" input in the calculator and watch your affordable home price jump. Focusing on paying off a small loan before you apply for a mortgage can make a massive difference.

2. Increase Your Down Payment

Saving more for a down payment helps in two ways. First, it directly reduces the Loan Amount you need to borrow, which lowers your monthly P&I payment. Second, a larger down payment (especially 20% or more) can help you avoid Private Mortgage Insurance (PMI), which is an extra monthly fee lenders charge on "high-risk" loans that isn't even included in this calculation. A larger down payment makes you a stronger, less-risky borrower.

3. Boost Your Household Income

This is the other side of the DTI coin. Increasing your Annual Household Income (whether through a raise, a new job, a side business, or adding a co-borrower's income) directly increases the payment you can afford. This, in turn, boosts the home price you can qualify for. Use the calculator to set an income goal and see how it affects your target home price.

4. Re-evaluate Your Loan and Location

Sometimes, the numbers are fixed, but the expectations can change. A 15-year loan term will have much higher payments (and lower affordability) than a 30-year term. Likewise, the Property Tax and HOA Fee inputs are huge factors. A home in a neighboring town with lower tax rates, or a single-family home with no HOA fee, might be significantly more affordable even at the same price point. Be sure to research realistic local tax and insurance rates.

5. Polish Your Credit Score

Your credit score is the single biggest factor controlling your interest rate. The difference between a 680 score and a 760 score can be as much as 0.5% to 0.75% in interest. On a $400,000 loan, improving your score could lower your monthly payment by over $200—without you paying an extra dime in down payment. Check your report for errors before you apply.

People Also Ask (FAQ)

Q1: What is the "28/36 Rule" and should I follow it?

- 28% (Front-End Ratio): Your new total housing payment (Principal, Interest, Taxes, Insurance) should be no more than 28% of your gross monthly income.

- 36% (Back-End Ratio): Your total housing payment plus all your other monthly debts should be no more than 36%.

Q2: What do lenders look at besides DTI and income?

- Credit Score: This is a massive factor. A higher credit score (e.g., 740+) will get you a much lower interest rate, which significantly increases your affordability.

- Credit History: They look for a history of on-time payments, the age of your credit accounts, and a healthy mix of credit types.

- Cash Reserves: Lenders want to see that you have cash left over after closing. This "post-closing liquidity" (often 2-6 months of PITI payments) proves you can handle an emergency without missing a mortgage payment.

- Employment Stability: They want to see a stable, verifiable (e.g., 2+ years) employment history in the same field.

Q3: What's the difference between Pre-Qualified and Pre-Approved?

- Pre-Qualification: This is a quick, informal estimate of what you might be able to borrow. It's based on self-reported data (like using this calculator) and often doesn't involve a credit check. It's a good first step, but it holds no real weight.

- Pre-Approval: This is a formal, conditional commitment from a lender to give you a loan up to a certain amount. You must submit a full application, including proof of income, assets, and debts. The lender will pull your credit. A pre-approval letter shows sellers you are a serious, credible buyer.

Q4: How much income do I need to buy a $400,000 house?

It depends heavily on your debts and down payment. Below is a breakdown using standard 2025 underwriting assumptions (7.0% rate, ~$400/mo debts):

| Scenario | Down Payment | Est. Monthly Payment (PITI + PMI) |

Required Income (Annual Gross) |

|---|---|---|---|

| FHA Loan | 3.5% | ~$3,300 | ~$110,400 |

| Conventional (5% Down) |

5% | ~$3,150 | ~$105,000 |

| Conventional (20% Down) |

20% | ~$2,750 | ~$91,800 |